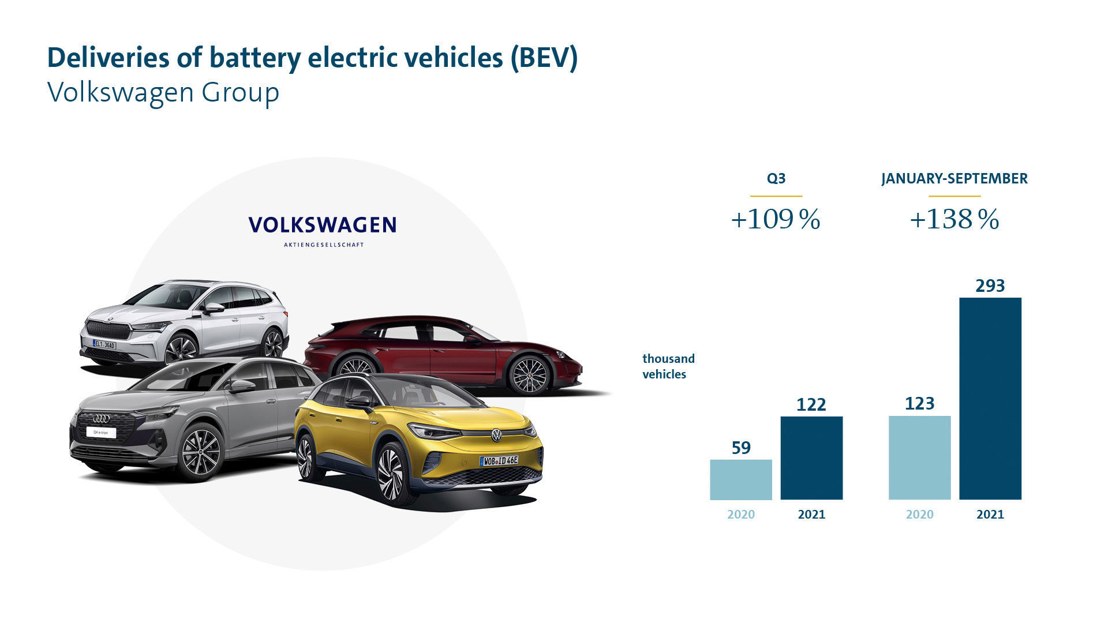

Volkswagen Group doubles deliveries of pure e-vehicles in third quarter

Vendredi 15 octobre 2021

- Despite semiconductor shortages, new record of 122,100 BEVs in Q3 (+109 percent on previous year)

- Market ramp-up in China accelerated significantly: 28,900 BEVs delivered in Q3 (H1 18,300)

- Global BEV share of total deliveries rises to more than 6 percent in Q3

- Worldwide deliveries of battery electric vehicles (BEVs) up 138 percent to 293,100 vehicles after nine months

- Christian Dahlheim, Head of Group Sales: “Our global electric offensive continues to run at full speed: we are clearly the number 1 for all-electric vehicles in Europe, and the number 2 in the USA. In China, we really took off in the third quarter, with deliveries of BEVs almost 60 percent higher than in the entire first half of the year. The strong demand for our global target for the year of one million electrified vehicles (BEVs+PHEVs) is definitely there.”

The Volkswagen Group successfully continued its global electric offensive in the third quarter of 2021. Despite a shortage of semiconductors, 122,100 BEVs were delivered to customers from July to September, an increase of 109 percent compared with the prior-year quarter. Particularly the market ramp-up in China accelerated significantly in Q3, where 28,900 BEVs were delivered, compared with 18,300 in the first half of the year. The BEV share of total deliveries rose to more than 6 percent in Q3. A total of 293,100 BEVs were delivered worldwide by the end of September, more than twice as many as in the prior-year period (+138 percent). There also continued to be strong demand for vehicles with a plug-in hybrid drive (PHEVs). A total of 246.000 PHEVs were delivered in the first nine months, more than twice as many as in the prior-year period (+133 percent).

In terms of BEV deliveries by region, Europe was still clearly in the lead, with 209,800 vehicles (share of 72 percent). The Group was the market leader here, accounting for a BEV market share of around 26 percent. In the USA, the Group delivered 27,300 BEVs, which corresponded to 9 percent of its global BEV deliveries. This gave the Group a market share of around 8 percent in the all-electric vehicle segment, putting it in the number two position. In China, 47,200 BEVs were delivered by the end of September; this represents 16 percent of the Group’s global BEV deliveries. In the third quarter, the accelerated market ramp-up meant that China accounted for a share of 24 percent. Christian Dahlheim: “As planned, we significantly accelerated the BEV market ramp-up in China in the third quarter, and we are on track to meeting our target for the year of delivering 80,000 to 100,000 vehicles of the ID. model family.”

By the end of September, the core brand Volkswagen delivered 167,800 BEVs to customers (share of 57 percent). This was followed by Audi with 52,800 vehicles (share of 18 percent), ŠKODA with 32,100 vehicles (share of 11 percent), Porsche with 28,600 vehicles (share of 10 percent) and SEAT with 8,800 vehicles (share of 3 percent).

The top 5 BEV models in the nine-month period were as follows:

– Volkswagen ID.4 72,700 units

– Volkswagen ID.3 52,700 units

– Audi e-tron (incl. Sportback) 36,100 units

– Porsche Taycan (incl. Cross Turismo) 28,600 units

– ŠKODA Enyaq iV 28,200 units

Volkswagen Group – deliveries of battery electric vehicles (BEVs) to customers

| Deliveries to customers | Jul. – Sep. | Jul. – Sep. | Delta (%) | Jan. – Sep. | Jan. – Sep. | Delta (%) |

| Europe | 81,700 | 45,300 | +80.5 | 209,800 | 95,200 | +120.3 |

| USA | 8,800 | 4,400 | +102.1 | 27,300 | 8,800 | +212.1 |

| China | 28,900 | 7,000 | +315.2 | 47,200 | 15,700 | +201.3 |

| Rest of world | 2,700 | 2,000 | +35.3 | 8,800 | 3,400 | +159.0 |

| Worldwide | 122,100 | 58,600 | +108.5 | 293,100 | 123,000 | +138.2 |

| Deliveries to customers by brand | Jul. – Sep. | Jul. – Sep. | Delta (%) | Jan. – Sep. | Jan. – Sep. | Delta (%) |

| Volkswagen Passenger Cars | 75,000 | 29,500 | +154.4 | 167,800 | 62,300 | +169.2 |

| Audi | 20,000 | 15,500 | +29.1 | 52,800 | 34,900 | +51.4 |

| ŠKODA | 14,400 | 4,600 | +214.8 | 32,100 | 9,500 | +236.8 |

| SEAT | 2,700 | 2,100 | +29.6 | 8,800 | 4,200 | +109.6 |

| Porsche | 8,800 | 6,500 | +36.4 | 28,600 | 10,900 | +161.7 |

| Volkswagen | 1,100 | 400 | +197.1 | 2,300 | 900 | +150.1 |

| MAN | 100 | 100 | +1.5 | 600 | 200 | +157.5 |

| Scania | - | - | - | - | - | - |

| Navistar | - | - | - | - | - | - |

| Others* | - | - | - | - | - | - |

| Volkswagen Group | 122,100 | 58,600 | +108.5 | 293,100 | 123,000 | +138.2 |

*Others include Bentley, Lamborghini and Bugatti